I’m still fighting for reimbursement of my peripheral and sacral stimulation implants.

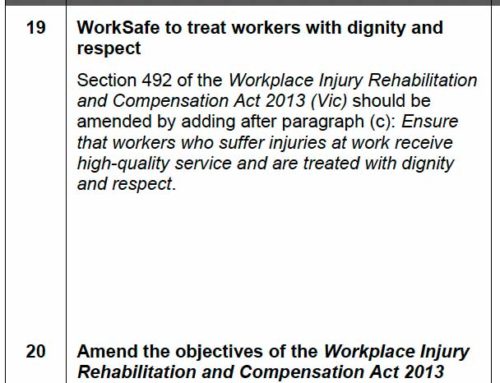

Insurer X (let’s call them that but really what I call them is irrelevant – they’re all the same!) are investigating valid reasons to support my treatments (or rather seeking reasons NOT to). Having already rejected liability for my peripheral stim implant (2011), Insurer X, with all their grace are asking for further information in regard to my sacral stim (2015).

One of the questions forwarded to my specialist reiterated to me once again how backward this system is. The insurer is searching for ‘negative’ factors?!

Any psychological risk factors that may negatively impact on the success of the IPT procedure.

After this first lot of info was provided by Vicpain, Insurer X requested more:

Insurer X can pay the reasonable costs of elective surgery required as a result of a work-related injury or illness in accordance with Victorian workers’ compensation legislation.

Further information required Insurer X requires you to provide a brief report on your perspective of the trial outcome and reasons for proceeding to permanent implantation in 2015.

As well as this ongoing battle for quite a few thousand dollars, our new business struck telco issues and callers phoning the landline would hear we were no longer connected.

This has been ongoing for the last 4 months! We had to get a new number.

Needless to say, this was a financial disaster for Theo and I and we notified Insurer X to ask what consequences there are for an injured worker if their wage falls short for a period of time.

I have been advised that a reduction in earnings is a fluctuation. As I advised, for S93CD claims prior to 5 April 2010, only one fluctuation is allowed in a 12 week period. Whilst I thought that this reduction would be one fluctuation, if Soula’s earnings were maintained at this reduced level, it would be considered a series of fluctuations from her previous earnings. Therefore, this would result in a decision to cease her entitlement under S93CD.

Soula would then need to reapply (submit a new post second entitlement application) for her reduced wage. The problem with this is that as Soula’s injury pre-dates 5 April 2010, the S93CD application’s are mandatory referrals to the Medical Panel.

I appreciate this is a very complicated outcome from a reduction in earnings. However, a reduction in earnings results in an increase in WorkCover benefits and the legislation and requirements around S93CD entitlements, especially for injuries sustained pre 5 April 2010, are very challenging.

At this point, I found myself wishing I could kick myself and Theo for being brave, for trying to persevere with a chronic illness, for starting our lives over, for going without seeing family, friends, for committing to a 1km radius for 95% of my days and for not staying in our beautiful home, in our home town of Collingwood, on my full entitlements.

I have just learned why injured workers have been reported to put their neck braces on before stepping outside.

If an injured worker is not supported in their attempts to return to work, then why would they risk trying to find new work? Remember, I can’t work in my previous employment scenario so in order to find new ways to work, I have to attempt many different things (as I have, as both Theo and I have).

Many of the work ideas we’ve tried haven’t worked and it wasn’t until many months that we could know this for sure. Each time we tried and each time we were not successful, Insurer X was not there. In fact the first time our attempts failed, Insurer X completely retracted all payments and I was left without any support for almost a year until the matter was processed at the system’s snail pace.

This can’t be fair.

Worse still… I’m paying a premium as a self employer through this whole process.

Leave A Comment